Hollingsworth Edwards Solicitors

London Solicitor

5 Solicitors

Does not accept legal aid

Qredible can put you in touch with a solicitor:

London Solicitor

5 Solicitors

Does not accept legal aid

Stockport Solicitor

3 Solicitors

Does not accept legal aid

Plymouth Solicitor PL4 9BD

18 years of experience

Accepts legal aid

Gemma Stevens is an experienced family law solicitor based in Plymouth, with 18 years of practice in the field. She qualified as a solicitor in 2007 after completing her Law degree at Plymouth University and the Legal Practice...

Derbyshire Solicitor DE55 7DD

41 years of experience

Does not accept legal aid

With 41 years of experience, Mark Cairns is a seasoned solicitor specializing in residential and commercial conveyancing, wills, trusts, estates, and neighbour disputes. Having joined Rickards & Cleaver in 1986 and later becoming a Partner, he has a...

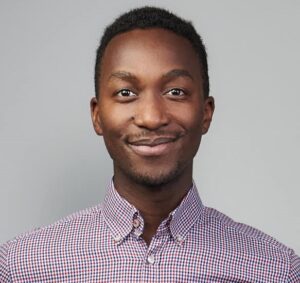

London Solicitor EC4A 2AB

7 years of experience

Does not accept legal aid

Vince Adon is a London-based lawyer with seven years of experience, specializing in a diverse range of legal areas, including education, employment, family law, divorce, mediation, immigration, litigation, bankruptcy, conveyancing, and consumer rights. With a strong academic background,...

Stockport Solicitor SK1 3SU

32 years of experience

Accepts legal aid

Kieran Henry is an experienced solicitor based in Stockport with 32 years of expertise in criminal law, family law, mediation, and civil litigation. As the founding member of his own law firm, Kieran has built a reputation for...

London Solicitor W6 7PJ

Does not accept legal aid

James qualified as a solicitor in 2013 and specialises in civil litigation, employment, crime and extradition. James has higher rights of audience in criminal courts which allows him to represent clients in the Crown Court and all Criminal...

London Solicitor SE18 6FH

15 years of experience

Does not accept legal aid

With 15 years of experience, Sushil Gaikwad specializes in a wide range of legal areas, including employment, family law, commercial law, and financial services. He offers expert legal services in areas such as dispute resolution, immigration, intellectual property,...

Twickenham Solicitor TW1 4SU

27 years of experience

Does not accept legal aid

Charlotte McConnell is a highly experienced solicitor based in Twickenham, specializing in intellectual property and commercial law. Having established McConnell Law in 2007, Charlotte has over 25 years of legal expertise, offering contract and commercial services to a...

Harrow Solicitor HA5 1BN

Does not accept legal aid

Reina D’costa, the founder of Bizlaw UK, is a savvy, practical and proactive UK Solicitor (dual qualified in the UK and India). She has many years of legal experience and great testimonials. She has a proven track record...

Northampton Solicitor NN2 6EZ

28 years of experience

Does not accept legal aid

Ruth Taylor is a highly experienced family law solicitor with 28 years of expertise in the field. She began her career in family law in 1985 as a secretary to a family law solicitor before qualifying as a...

London Solicitor W1C 2DL

22 years of experience

Does not accept legal aid

Kumar Subramani is a highly experienced solicitor based in London, fluent in Bengali, English, Greek, Hindi, Malay, Turkish, Urdu, Tamil, and Malayalam. With over 22 years of legal experience, he offers a broad range of services, specializing in...

London Solicitor NW10 4UA

32 years of experience

Does not accept legal aid

James Tomkins is a highly experienced litigation and dispute resolution lawyer based in London, with 32 years of expertise in civil, commercial, and employment law. He is a Director at Hodders Law Limited and leads the firm's Litigation...

London Solicitor EC4A 1BL

Does not accept legal aid

Kaizad Cassad is a distinguished lawyer based in London, known for his expertise in criminal law, fraud, intellectual property, and dispute resolution. As the founder of his firm, Kaizad envisioned a legal practice with a strong international presence,...

Birmingham Solicitor B10 0LL

13 years of experience

Does not accept legal aid

I am an Immigration Law Specialist with extensive experience in dealing with a wide variety of Human Rights Issues, including Asylum, Points Based System, Deportation/Removals, Admin Reviews as well as all levels of Appeals and Judicial Reviews. I...

Cwmbran Solicitor NP44 1UG

29 years of experience

Does not accept legal aid

Catherine Watkins is an experienced family and property lawyer based in Cwmbran & Barry and cover South wales & Bristol, with 29 years of legal expertise. Fluent in both English and Welsh, Catherine is a key member of...

Liverpool Solicitor L3 1HU

15 years of experience

Does not accept legal aid

I start working with Michael Rose Baylis Ltd in January 2019 and started the Immigration department, while also handling residential and commercial conveyancing matters. Immigration matters: Dealt with the applications for entry clearance visa for visit, spouse visa,...

Surrey Solicitor SM3 9AA

24 years of experience

Does not accept legal aid

Jacqueline McCaulay is a highly experienced family law solicitor based in Surrey, with 24 years of expertise in divorce, matrimonial finance, and children matters. She provides tailored legal solutions to clients facing complex family law issues, ensuring a...

Leeds Solicitor LS1 3HB

8 years of experience

Does not accept legal aid

Giselle Brown is the founder of GDB Legal, a boutique immigration firm providing personalised service at an affordable price. The firm specialises in helping individuals and families, as well as corporations, obtain UK visas and permits. With 17...

Harrow Solicitor HA1 1BQ

14 years of experience

Does not accept legal aid

Kajal Patel is a highly skilled solicitor with 14 years of experience, specializing in commercial property, corporate, and business transactions. She began her career at a City firm and continued working in the City after qualification. For the...

London Solicitor W1J 6ER

Does not accept legal aid

Dalir Ltd is a boutique law firm based in London, offering specialized legal services to both UK and international clients. The firm focuses on providing tailored legal and commercial solutions across various industries, with a particular expertise in...

Belfast Solicitor BT1 3GN

47 years of experience

Accepts legal aid

Areas of Practice Personal Injury My firm McKeowns is recognised as a leading Personal Injury practice within Northern Ireland. Our approach to handling claims has been centred entirely on caring for clients. From the moment of instruction until...

Stockport Solicitor SK5 7DL

34 years of experience

Does not accept legal aid

James Byrne is an experienced solicitor based in Stockport, with a career spanning over four decades. He graduated from Manchester University Law School in 1986 and qualified as a solicitor in 1990. Throughout his extensive career, James has...

London Solicitor W10 5AD

32 years of experience

Does not accept legal aid

Having studied Law at the University of Birmingham, I have been practising as a solicitor specialising in commercial property for over 20 years. I advise a broad range of clients on a variety of commercial property issues, including...

Amersham Solicitor HP6 6FA

27 years of experience

Does not accept legal aid

Having started my career in the Commercial Litigation department of one of the larger firms in the City of London I have spent the last 20+ years working both in private practice and in-house, gaining valuable experience of...

Guildford Solicitor GU1 4QH

7 years of experience

Does not accept legal aid

Aurelia Winter is a licensed conveyancer based in Guildford, specialising in residential property transactions, transfer of equity, and land-related legal matters. With extensive experience in handling freehold and leasehold sales and purchases, new build purchases, transfers of part,...

London Solicitor NW8 6AR

35 years of experience

Does not accept legal aid

Oakland & Co is a firm of solicitors specialising in Employment Law. Daniel Oakland is the Principal of the firm. He is a solicitor and a qualified barrister with nearly 30 years experience of dealing with the full...

Buckinghamshire Solicitor HP5 1EG

9 years of experience

Does not accept legal aid

Tamara Barbeary is a solicitor based in Buckinghamshire, with 9 years of experience in the field of employment law. She is the Head of Employment Law at Lennons Solicitors, a law firm with offices in Chesham, Amersham, and...

Guildford Solicitor GU3 1YL

32 years of experience

Does not accept legal aid

Maria Guida is a Senior Associate in the Real Estate team, based in Guildford, with 32 years of experience in commercial property and licensing law. She specialises in landlord and tenant matters, real estate litigation, commercial conveyancing, and...

Bicester Solicitor OX27 8BL

9 years of experience

Does not accept legal aid

Shortlisted for the Modern Law Awards 2025 'Rising Star of the Year', and with over a decade of experience, Roy is dedicated to understanding what results you need; providing you with an informed basis upon which to make...

Wolverhampton Solicitor WV1 4EX

17 years of experience

Does not accept legal aid

With 17 years of experience, Andrew Akhuetie specializes in employment law, family law, immigration, and litigation. He is dedicated to ensuring that clients' rights are upheld, especially in employment-related matters. Areas of Expertise Employment Law – Specializing in...

Uxbridge Solicitor UB8 1QG

22 years of experience

Does not accept legal aid

Taslim Khan is an experienced solicitor based in Uxbridge, with 22 years of legal practice. She is fluent in English, French, Punjabi, and Urdu, allowing her to serve a diverse range of clients effectively. Over the years, Taslim...