Qredible can put you in touch with a solicitor:

London Solicitor

5 Solicitors

Does not accept legal aid

Stockport Solicitor

3 Solicitors

Does not accept legal aid

Amersham Solicitor HP6 6FA

27 years of experience

Does not accept legal aid

Having started my career in the Commercial Litigation department of one of the larger firms in the City of London I have spent the last 20+ years working both in private practice and in-house, gaining valuable experience of...

London Solicitor SE14 5DB

26 years of experience

Does not accept legal aid

He can advise and act as an owner of a business established during a recession with a wide experience of construction contracts and the management of conflict in all its various dimensions (commercial, political and personal) in the...

Nottingham Solicitor NG2 4GT

16 years of experience

Does not accept legal aid

With 16 years of experience, Aldijana Hoad specializes in immigration law. Fluent in Croatian, English, and Serbian, she provides expert legal services in both corporate and personal immigration matters. With a law degree from Nottingham Trent University and...

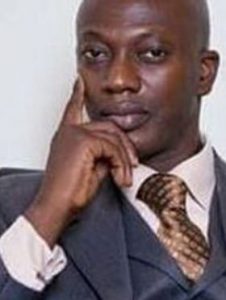

Middlesex Solicitor HA1 3RA

24 years of experience

Does not accept legal aid

Richard Boateng is a solicitor based in Middlesex with 24 years of experience across multiple legal disciplines, including criminal law, employment law, family law, immigration, bankruptcy, and consumer rights. His extensive expertise and dynamic approach enable him to...

London Solicitor EC3V 4AB

8 years of experience

Does not accept legal aid

Lawlex Solicitors is a London-based law firm led by a highly qualified solicitor with eight years of experience in immigration law and dispute resolution. Fluent in English, Georgian, and Russian, the firm provides expert legal services to a...

Chesterfield Solicitor S41 7TD

21 years of experience

Does not accept legal aid

Natalia Delgado is a highly experienced solicitor based in Chesterfield, with 21 years of expertise in commercial and business law. She is the Head of the Commercial Team at Elliot Mather LLP, where she has worked since 2002,...

Birmingham Solicitor B12 0NS

11 years of experience

Does not accept legal aid

Qarrar Somji is a solicitor based in Birmingham, specializing in a wide range of legal areas, including Alternative Dispute Resolution (ADR), Bankruptcy, Civil Litigation, Court Claims, Defamation, Dispute Resolution, Divorce, Employment Law, Family Law, Insolvency, Landlord & Tenant Litigation, Neighbour Disputes, Tribunals, Trust & Estate Disputes, and Wills. With his extensive experience across...

West Midlands Solicitor DY14 9HZ

12 years of experience

Does not accept legal aid

Sophie Donovan is an experienced solicitor based in the West Midlands, specializing in a wide range of legal areas, including family law, Wills and probate, debt recovery, and residential conveyancing. With 12 years of experience in the legal...

Hampshire Solicitor PO16 7BL

7 years of experience

Does not accept legal aid

Claire Bond is a dedicated personal injury lawyer based in Hampshire with seven years of experience. She does not accept legal aid. Claire has built a strong practice representing clients in a wide range of personal injury claims,...

Derbyshire Solicitor DE55 7DD

18 years of experience

Does not accept legal aid

With 18 years of experience, Liz Garratt is a highly skilled Private Client Solicitor specializing in Conveyancing, Wills, Trusts, and Estates. Having been in the legal profession since 2007, Liz offers a compassionate and client-focused approach to legal...

Birmingham Solicitor B10 0LL

13 years of experience

Does not accept legal aid

I am an Immigration Law Specialist with extensive experience in dealing with a wide variety of Human Rights Issues, including Asylum, Points Based System, Deportation/Removals, Admin Reviews as well as all levels of Appeals and Judicial Reviews. I...

Plymouth Solicitor PL4 9BD

18 years of experience

Accepts legal aid

Anne Shears is a solicitor based in Plymouth with 18 years of experience specializing in family law and divorce. She provides expert legal services tailored to resolving financial matters and family disputes. In Family Law and Divorce, Anne...

London Solicitor EC1V 2NX

6 years of experience

Does not accept legal aid

I am an immigration advisor working with Worldwide Immigration. I have around ten years experience in legal field. I keep myself abreast with the latest developments in immigration law. Since, I believe that up to date knowledge of...

Warwickshire Solicitor CV37 6YX

35 years of experience

Does not accept legal aid

With 35 years of experience, Caroline Irvine is a trusted lawyer specializing in conveyancing, agricultural property, and landlord-tenant matters. She provides clear, practical advice to ensure smooth property transactions for her clients. Areas of Expertise Residential Conveyancing –...

London Solicitor W6 7PJ

Does not accept legal aid

James is a solicitor who specialises in criminal, licensing, and professional disciplinary matters. He represents clients in investigations, trials, and appellate and judicial review proceedings. He has received praise from clients and their families, fellow lawyers, and Magistrates....

Harrow Solicitor HA1 1BQ

37 years of experience

Does not accept legal aid

Sandeep Lakhani is a highly experienced lawyer based in Harrow, with an impressive 37-year career in conveyancing and property law. Specializing in landlord and tenant matters, land and property transactions, and residential conveyancing, he provides expert legal guidance...

Southall Solicitor UB1 3DB

23 years of experience

Accepts legal aid

Amir Masood is a highly experienced solicitor and Senior Accredited Caseworker with over 15 years of expertise in immigration law. Based in Southall, he has built a distinguished career handling complex immigration, asylum, nationality, and human rights cases,...

Birmingham Solicitor B18 7AF

18 years of experience

Does not accept legal aid

Paschal Ihebuzor is a highly experienced solicitor based in Birmingham, with 18 years of legal practice. Specialising in employment law, family law, immigration, litigation, and judicial review, Paschal provides expert legal services with a deep commitment to achieving...

Shotton Solicitor CH5 1BY

37 years of experience

Does not accept legal aid

Personal Injury & Conveyancing Solicitors in Wales & Cheshire PSR Solicitors is a leading firm of Serious & Personal Injury Solicitors in Wales and Cheshire. From time to time accidents do happen and unfortunately, it is true to...

London Solicitor EC4V 5EF

16 years of experience

Does not accept legal aid

David Pritchard is a seasoned litigation and dispute resolution solicitor based in London, with 16 years of experience handling a broad range of complex legal matters. As a partner at SBP Law, he represents corporate clients, individuals, and...

London Solicitor W10 5AD

11 years of experience

Does not accept legal aid

As an experienced commercial solicitor, having previously worked for 9 years at a highly successful FTSE 100 company in London as Senior Corporate Counsel, I joined Lawbite in 2018 for the opportunity to work with a variety of...

Lancashire Solicitor L40 0SA

32 years of experience

Does not accept legal aid

Stephen Davies is a highly experienced lawyer based in Lancashire, with 32 years of expertise in mediation, litigation, civil litigation, and conveyancing. Specializing in both residential and commercial conveyancing, he offers expert legal support in property transactions, including...

Wigan Solicitor WN3 5BA

32 years of experience

Does not accept legal aid

I am a Partner in the family law team at Stephensons. I joined Stephensons in 1992 and have specialised in family law ever since. Separation and family disputes can bring a variety of situations which require careful management,...

London Solicitor UB4 9AS

Accepts legal aid

Chris William is a highly regarded litigation and arbitration lawyer based in London, with a strong focus on media, technology, and intellectual property disputes. Fluent in Albanian, English, and Arabic, Chris specializes in intellectual property law, including patents,...

London Solicitor W1J 6ER

Does not accept legal aid

Dalir Ltd is a boutique law firm based in London, offering specialized legal services to both UK and international clients. The firm focuses on providing tailored legal and commercial solutions across various industries, with a particular expertise in...

London Solicitor EC3V 3ND

28 years of experience

Does not accept legal aid

In my almost 22 years, as a Family Lawyer I would say the most rewarding aspect of what I do is build relationships with my clients and help them to successfully move on with their lives without all...

London Solicitor EC2N 1HN

20 years of experience

Does not accept legal aid

Jai is a senior legal consultant with the Alston Asquith corporate/commercial team with extensive international and London City work experience. A Cambridge University Law alumnus, Jai has particular expertise in relation to complex transactions, including in the areas...

Buckinghamshire Solicitor HP6 5BW

17 years of experience

Does not accept legal aid

Mike Wragg is the Head of Residential Property at Lennons Solicitors, a well-established law firm in Buckinghamshire with offices in Chesham, Amersham, and Beaconsfield. With 17 years of experience, Mike specialises in all aspects of residential property law,...

London Solicitor SW2 5UT

17 years of experience

Does not accept legal aid

Mo Jaufurally is a highly experienced solicitor based in London, with 17 years of legal practice. Fluent in both English and French, he specialises in criminal law, employment law, family law, immigration, and litigation. He does not accept...

Leeds Solicitor LS25 5BQ

23 years of experience

Does not accept legal aid

Angela Lally is a solicitor based in Leeds with 23 years of experience specializing in family law and divorce. She provides expert legal services tailored to matrimonial finances and family matters. In Family Law and Divorce, Angela advises...